Tag Archives: FoodAngel

VIETNAM EXPECTED TO BE THE PRIME BENEFICIARY OF US-CHINA TRADE WAR

HCMC Property Market Prices Growing by Leaps and Bounds

(27 July 2018, Hong Kong)

US-China Trade War – How Vietnam can benefit?

With President Donald Trump’s recent proposal of imposing heavy tariffs to 200 types of Chinese goods, the US-China trade war has kicked off. Heavy trade tariffs on goods of both countries’ exports are imposed. Vietnam, which is not embroiled in the conflict, is foreseen to be a potential beneficiary between the rival of the two super powers.

In the past decade, factory wages and other costs have risen in China at a rapid pace, as a result, corporations have turned to developing Southeast Asia countries such as Vietnam for investment. Foreign investors in particularly big corporations such as Samsung and Apple have shifted their manufacturing factories to Vietnam as it becomes a lower-cost destination for investors. With the US-China trade war, it accelerates an existing trend of foreign business veering away from China and entering Vietnam, so as to avoid the high tariffs for “Made in China” goods.

The General Statistics Office of Vietnam revealed that Vietnam has attracted a total of USD20.33 billion worth of foreign direct investments in the first half of 2018 with manufacturing and post-production industries attracted the highest number of foreign direct investments, totaling to USD7.91 billion. The FDI sector accounts for approximately 70% of the country’s export turnover, equivalent to 22% of GDP. Due to the increase in Vietnamese exports with the US-China trade war, an increase in labour demand will be triggered, acting as the key driver to output (GDP) and employment growth. All these factors gave rise to a booming economy, fueling rapid property market growth in the country.

Waterina Suites – Highest Standard Residential Building in Vietnam

Waterina Suites is a joint venture property development by the world-class developer Maeda Corporation (Japan) and Thien Duc Company. Nestled at the heart of District 2 which is known as the city’s expatriate area, Waterina Suites is situated at an unbeatable location which is prioritized among investors. District 2 is only minutes away to the heart of the city by Thu Thiem Tunnel and the upcoming Thu Thiem Bridge, comparable to the West Kowloon district in Hong Kong. An array of amenities is available only minutes away – renowned international schools, the “SOHO” area of HCMC, restaurants, bars, luxury hotels, supermarkets, malls and cinemas, which is a convergence of convenience and luxury.

Designed by the world-famous Mr. Kengo Kuma who also is lead architect of New National Stadium – Japan, Waterina Suites is a work of art created by a master. Set to become one of Ho Chi Minh City’s future landmarks, its elegant overlapping curved design is inspired by the organic curve of the Saigon River and the layers of terraced paddy fields in highlands of Vietnam with the units offering spectacular views over Saigon River with surrounding landscaped gardens.

Waterina Suites stands at 25-storeys high with a podium composing of 98 luxurious suites of penthouse, duplex and single floor units that comes complete with its very own car park, swimming pool, spa and business centre. It offers a wide range of state-of-the-art facilities including its magnificent infinity swimming pool overlooking Saigon River, business centre, bar, library and restaurant for residents to indulge in a luxury lifestyle. As one of Maeda Corporation’s key projects in Vietnam, Waterina Suites are constructed according to Japanese standards. The best materials and construction methods are used – kitchen ventilation systems, elastic paint at outer wall to increase cracking resistance, concrete wall to avoid water leakage and sound insulation and waterproofing for roof slab. As an award-winning developer, Maeda Thien Duc strives to provide residents the best living experience in this highest standard residential building in Vietnam. It is expected to be completed by Q3 2019.

Unparalleled Infrastructure in HCMC District 2

The metro system under construction in HCMC District 2 is believed to further accelerate land and property prices. Six metro lines have been planned and two of which, Metro Line No. 1 and Metro Line No. 2 are expected to be in service in 2020, serving around 160,000 passengers daily. Projects around the upcoming metro lines are currently selling at a few percent premium, compared with the prices of those with similar facilities in other parts of the city. When the metro lines run in 2020, it is expected the gap would be widened by 10 to 20 percent. The centre of District 2 are key areas surrounding the upcoming metro stations, in which property development boom have been recorded with an average growth of more than 30% in the last few years, outperforming other districts in HCMC.

Leading developer of Waterina Suites – Maeda Corporation

Headquartered in Japan and listed on the Tokyo Stock Exchange, Maeda Corporation is one of the largest and long-standing corporations in civil, industrial & infrastructure construction of Japan. Established in 1919, Maeda Corporation has global presence with branches in 15 countries in the world. Its key projects in Japan include The Tokyo Towers, Tennoz Central Tower, Fukuoka Dome, Tagokura Dam, Seto Ohashi Bridge and Tokyo Bay Aqua Line etc.

Maeda Corporation is the general contractor of major projects in Hong Kong such as the Hong Kong International Airport, Hong Kong Stonecutter Bridge, Tsing Yi MTR Station and West Kowloon Expressway. As the contractor of the HCMC’s Ben Thanh – Suoi Tien metro line station, Maeda Corporation also has planted its roots in Vietnam with over 25 years of presence, using modern technology in Vietnam with Japanese quality.

Maeda Corporation has formed a joint venture with Thien Duc Company to develop the renowned Waterina Suites. Thien Duc Company belongs to Long Thanh Golf Company, specializing in real estate development, hospitality and green energy.

Dr. Tetsuo Kida, Representative of Maeda Corporation, General Director of Maeda Thien Duc company, said: “Waterina Suites is like no other, it is the perfect choice for the ultra-affluent. We designed this magnificent condominium to provide our residents with an unexceptional experience especially for Japanese expats living in the city. As one of the most respected and highly sought brands in the luxury property market, we endeavor to uphold our standard of excellence in all our property projects. With the significant increase in demand for luxury properties in Ho Chi Minh City, and our future plans is to continue in constructing distinctive properties with the highest Japanese standards in Vietnam.”

Mr. Kingston Lai, Managing Director of Ashton Hawks, added that, “Vietnam’s property market can be benefited from the positive effects that the US-China trade war. As a competitor of China as the “world factory”, it is expected that an increasing number of factories will be moved to Vietnam as “Made in Vietnam” products can avoid the heavy tariffs when it is imported to the United States especially on agricultural and industrial goods. It is expected that Vietnamese exports to China and United States will increase followed by an increase in GDP. The rise in GDP capita shall increase the purchasing power of the Vietnamese, thus demand in the housing market. It can be foreseen that there will be more local aggregate demand in the Vietnamese property market after the US-China trade war.”

Mr. Terence Chan, Managing Director of Ashton Hawks states that “With the increase in Vietnam’s FDI and the start of the US-China trade war, more people are moving to Vietnam to do business or open factories, greatly boosting the number of expats living in Vietnam. As they are primarily entrepreneurs or professionals, their choice of abode will be in the more affluent neighborhoods. Waterina Suites is perfectly located at District 2, one of the most sought after residential areas among the expatriate community. Its lush environment is extremely attractive to affluent foreigners and locals, with luxury villas prevalent in the area. The increase in expats shall increase the foreign demand for Vietnamese property market and rental housing – a favourable factor to higher property market prices and rental yields in the future.”

The launch of Waterina Suites will take place on 4-5 August 2018 in The Park Lane Hong Kong (26/F, 310 Gloucester Road, Causeway Bay).

– End –

For media enquiries, please contact:

Ashton Hawks

Cherry Chan

PR & Branding Vice President

Email: cherry.chan@ashtonhawks.com

Tel: (852) 2912 0960

About Ashton Hawks

Ashton Hawks was established by a group of renowned investment gurus and private collectors who laid the very foundation of the discerning Ashton Hawks, balancing luxury leisure lifestyle and investment. Our headquarter office is located in Hong Kong, with overseas branches in Bangkok and Vietnam. Ashton Hawks’ real estate portfolio is as diverse in style as it is in mega-estate location across the globe and caters to luxury style of all kinds.

For more information, please visit us at www.ashtonhawks.com.

Subscribe our newsletter

Asia Bankers Club founder and chief executive Kingston Lai sees future potential in property markets in Ho Chi Minh City, Hanoi, New York City, Manchester – but he has reservations about London and cities in Australia.

In addition to the investment club targeting bankers and professionals, Lai also controls Ashton Hawks and Golden Emperor Properties, which aim at high net worth individuals and retail investors, respectively, for overseas real estate.

Amid a number of uncertainties, Lai reckons real estate buyers need to think twice. “But the more uncertainty people see from the trade war, the more they are interested in properties in Vietnam, where more manufacturers are expected to move from China.” He says a recent project in HCMC received an overwhelming response.

“Even if the Hong Kong property market were to fall, would flats now valued at HK$10 million plunge to HK$5 million? However, two-room apartments sized between 700 and 1,000 square feet in district 2 and 4 in HCMC cost around HK$2 million and they have the potential to rise further.”

He compares these areas to Sheung Wan, close to the central business district. Apartments further away from the CBD cost around HK$1.2 million only.

Property prices in HCMC have risen on average 15 percent a year over the past three years, compared with as much as 30 percent a year in Bangkok several years ago, says Lai. On average, there is 8 percent gross rental yield in HCMC, he says.

District 1 is the traditional CBD and district 3 is where many embassies and historical buildings are located. Investors have been looking at districts 2 and 4. Last month, the HCMC administration decided that no high-rise apartment projects in districts 1 and 3 will be approved until 2020. Lai expects supply to be even tighter.

He is also bullish on the property market in Hanoi, where Samsung, Apple and Microsoft have invested. The World Bank projected GDP growth in Vietnam to be 6.8 percent in 2018 and 6.5 percent in 2019.

Although Koreans and Japanese are the top foreign investors in Vietnam, Lai says they are not keen on buying properties, unlike Hong Kong and mainland Chinese, who can rent the flats to them. “You can compare HCMC and Hanoi with Shanghai and Beijing, respectively, but we are yet to find a Shenzhen in Vietnam,” Lai says.

Overseas people can buy property in Vietnam and sell or lease it to locals and foreigners. A 50-year leasehold ownership will be given to foreigners with renewal possibility.

When buying a property in Vietnam, investors are subject to 0.5 percent stamp duty. For rental income, they are subject to about 10 percent income tax. If they want to sell the property, 2 percent personal income tax of the selling price will be charged.

Foreigners need to have a bank account in Vietnam and need to sign the sales agreement in person. Mortgages are not available. He says the firm has helped a client to gain about 16 percent to buy and sell a property in Vietnam within a year.

Lai, a Malaysian Chinese, says it takes time to assess the political situation back home. He adds that properties in Singapore are too expensive to buy.

Investors in Thailand property should be cautious. Lai says that a studio in Bangkok near a metro station costs between HK$1 million and HK$2 million, while those costing only HK$500,000 may be in very remote areas that will be difficult to sell or rent out.

As for developed markets, Lai sees potential in New York City.

Sellers have been cutting prices there with less demand due to a tax reform that changes the mortgage interest and property tax deduction, making home ownership less attractive.

While this also applies to foreigners, Lai says some Hong Kong buyers note that the US-HK dollar peg minimizes currency risk. They expect long-term capital gain in New York City center, where there is continuing redevelopment and population growth.

Despite the interest among locals for London homes, Lai is cautious in the wake of Brexit and the high costs of investing there. He sees more potential in Manchester, which he believes could be a future London, Liverpool and Birmingham.

In Australia, Lai says banks will only provide construction financing to developers if they have sold a substantial amount of an uncompleted project. He worries some developers may struggle.

He also sees potential in Japanese real estate but the company does not have expertise there. “We only sell projects that we can manage. We sell about 1,000 units a year. We try our best to ensure customers’ properties are well-managed and can be rented out,” he says. “Selling projects by major developers is one of the ways in which we have peace of mind.”

He and his team carry out due diligence and even buy properties themselves to experience the process. Six months were spent studying the property market in Vietnam before identifying projects.

Ashton Hawks and Golden Emperor Properties serve clients with different needs.

“If you tell me HK$1 million cash is all that you have, I won’t tell you to place it all into a property in Vietnam.

“Instead, we have helped a retired customer to spend HK$500,000 to buy a condo in Thailand for his own use and the rest for his spending.

“Customers like bankers may bet on some properties in Southeast Asia and at the same time invest in London, or New York City, for long-term stable growth.”

Source: The Standard

Subscribe our newsletter

PRESS RELEASE

ROBUST U.S. ECONOMY – PRIME TIME FOR REAL ESTATE INVESTMENT

125 Greenwich – Residential skyscraper in Manhattan’s financial district

(2 November 2018, Hong Kong)

The U.S. economy has expanded at its fastest pace in 4 years in Q2 2018. The benchmark S&P 500 Equity Index has hit a record closing high in January 2018, symbolizing the swift recovery and remarkable performance of U.S. equities, which in turn boosts consumption and investment.

Fueled by U.S. economic strength and Federal Reserve raising interest rates, USD has maintained an upward momentum lately, surging 6% since February this year against other major currencies in the world and maintaining stable growth in the past decade. The strong USD has pushed investors to seek out the currency as a safe haven asset.

With the U.S. recommencing its economic growth, the renowned developer Bizzi & Partners Development grabbed the golden opportunity to launch a spectacular new property project in New York – 125 Greenwich in the heart of Manhattan.

125 Greenwich – Living in a masterpiece

Designed by world-renowned architect Rafael Viñoly, 125 Greenwich stands at 88-storeys high and offers 273 residences ranging from studios to three-bedroom and penthouse residences. Net sizes range from 418 – 3,018 square feet, with prices starting from HKD9.4M (USD1.2M).

Investors can expect a rewarding rental yield of 4% per annum with up to 70% financing. It offers future residents an exclusive chance to see the city from a new perspective and enjoy a pampered and lavish lifestyle – 15,000 square-foot amenities including sophisticated concierge services, sky pool with panoramic views of the bustling city, theater, private dining, sky lounge, spa & sauna and gym etc. It is expected to be completed by Q4 2019.

Nestled at Manhattan’s financial district, 125 Greenwich is the neighbor to a cluster of soaring skyscrapers such as One World Trade Center, which is comparable to “Central” in Hong Kong. The area comprises of offices and headquarters of multinational corporations and major financial institutions, including the New York Stock Exchange, Wall Street and the Federal Hall.

125 Greenwich offers residents a unique opportunity to experience life in the most sought-after locations and communities. Residents can discover the electric vibrancy of Manhattan downtown at this lively intersection of business and leisure – with the dynamic dining scene, luxury retails, architecture and proximity to Central Park. Its unrivalled location allows easy access to subways, ferries and other public transportation.

Internationally renowned developer – Bizzi & Partners Development

The pristine 125 Greenwich is the creation of the acclaimed U.S. developer Bizzi & Partners Development.

With offices in Milan, New York, San Paolo and Tallinn, Bizzi & Partners Development is a global high end real estate developer focused on the development of premier commercial and residential properties in Europe and the Americas. Founded in 2000, it is led by an executive team with decades of experience in real estate development, including the acquisition, financing, construction and renovation of a wide array of property types.

As one of the most respected and highly sought developer in the U.S. property market, the firm has an expansive portfolio of avant-garde and acclaimed projects. The firm’s current projects include Milanosesto: a 10 million square foot mixed-use project in Milan, and two additional collaborations with Pritzker Prize-winning architect Renzo Piano on Eighty Seven Park in Miami Beach and 565 Broome in New York’s SoHo neighborhood. Previous New York projects include the distinguished 400th Avenue and the Leonard in Tribeca.

Mr. Davide Bizzi, CEO of Bizzi & Partners Development said, “With the opening of a vast array of high-end restaurants and retail outlets in Manhattan’s financial district, this neighborhood has become one of the most desirable places to live and work. We capitalized on this golden opportunity and create this truly unmissable investment by acquiring the property at 125 Greenwich Street. By hiring the world-renowned Rafael Viñoly to redesign the building, we are confident that 125 Greenwich shall be an iconic skyscraper in the heart of New York and be popular among local and foreign investors as it is expected the redevelopment of the financial district will continue for another 10-15 years.”

Mr. Kingston Lai, Founder and CEO of Asia Bankers Club, added that, “Since the 9/11 attack in 2001, Lower Manhattan has seen a tremendous growth in residential population nearly tripling the number since the attack. More schools have been built and commercial buildings are being converted to residential condos. Once known as the neighborhood shuttered at nights and weekends, it has now been replaced by new residential buildings, more tourist attractions, and growth of high-end retails and restaurants. The future of residential population growth is tremendous in the lower Manhattan neighborhood.”

Mr. Terence Chan, Managing Director of Golden Emperor Properties states that, “125 Greenwich is nestled in the most impeccable location in New York’s financial district, in between the redevelopment around One World Trade Center and the traditional finance hub of Wall Street. The district now hosts a high-end luxury lifestyle most suited for its finance professionals amongst international firms like Goldman Sachs, Merrill Lynch and J.P. Morgan. Moreover, property price in Manhattan has remained steady within the last decade, increasing by only 50% with properties sold within an average of 100 days. Its rental market also shows excelling performance, with a low vacancy rate at 1.58% and properties renting out within 1 month. As a slow-rising property market in the USA under a steady economy with a revolutionary redevelopment plan, New York presents unique investment opportunities. The city’s strong tenant market, coupled with a high market liquidity on a global scale, are compelling reasons to invest into New York’s property market now.”

Ms. Michele Cheng, Director & Partner of Ashton Hawks said: “The current real estate prices in New York are of good value as it is lagging behind other major cities. According to UBS Global Real Estate Bubble Index, New York has a very low risk of real estate bubble burst compared to major world cities such as Hong Kong, Munich, Toronto and London. Prices of Manhattan’s properties has much upside potential as it has only risen by 70% in the past 10 years. The foreign investment in the U.S. luxury residential real estate market has also hit a record by reaching USD7.48 billion with Manhattan as one of the key locations for wealth preservation for the ultra-affluent.”

Mr. Frederick Ho, Director & Partner of Ashton Hawks commented, “Real estate in Manhattan’s financial district has also been a popular choice with occupancy rate over 98% in its rental market as demand for housing for locals and expats is huge. In terms of sales volume, condos in the financial district is one of the best performing districts within Manhattan. All in all, 125 Greenwich is the perfect choice for investors who wish to have a stable rental yield and capital gain of their property investment.”

The launch of 125 Greenwich in Hong Kong will take place on 10-11 November 2018 at The Park Lane Hong Kong (27/F, 310 Gloucester Road, Causeway Bay).

– End –

For media enquiries, please contact:

Ashton Hawks

Cherry Chan

PR & Branding Vice President

Email: cherry.chan@ashtonhawks.com

Tel: (852) 2912 0960

Golden Emperor Properties (HK) Ltd.

Christina Cheng

PR & Marketing Director

Email: christina@goldenemperor.com

Tel: (852) 2912 0920

Asia Bankers Club

Damian Sung

Associate Director

Email: damian@asiabankersclub.com

Tel: (852) 3998 3001

About Ashton Hawks

Ashton Hawks was established by a group of renowned investment gurus and private collectors who laid the very foundation of the discerning Ashton Hawks, balancing luxury leisure lifestyle and investment. Our headquarter office is located in Hong Kong, with overseas branches in Bangkok and Vietnam. Ashton Hawks’ real estate portfolio is as diverse in style as it is in mega-estate location across the globe and caters to luxury style of all kinds.

www.ashtonhawks.com

About Golden Emperor Properties (Hong Kong) Limited

Golden Emperor Properties (HK) Limited is a Hong Kong-based company that offers international properties to clients in Hong Kong and globally. The company works with property developers from Thailand, Japan, Malaysia, the United Kingdom, Europe and many others. The company has a team of dedicated sales agents that can provide consultancy and information on relevant transaction-related topics such as taxation, sales & purchase procedures, payment schedules, and many other.

www.goldenemperor.com

About Asia Bankers Club

The Asia Bankers Club is an investment club for banking and finance professionals in Asia. With a member base of over 50,000, the Asia Bankers Club organises events for its members and provides physical assets for investments, such as properties, fine wines, art, timepieces, and collectibles. Our members are from top tier investment, private and consumer banks, asset management companies, private equity firms, hedge funds, and sovereign wealth funds primarily located in key financial centers.

www.asiabankersclub.com

Subscribe our newsletter

Press Release

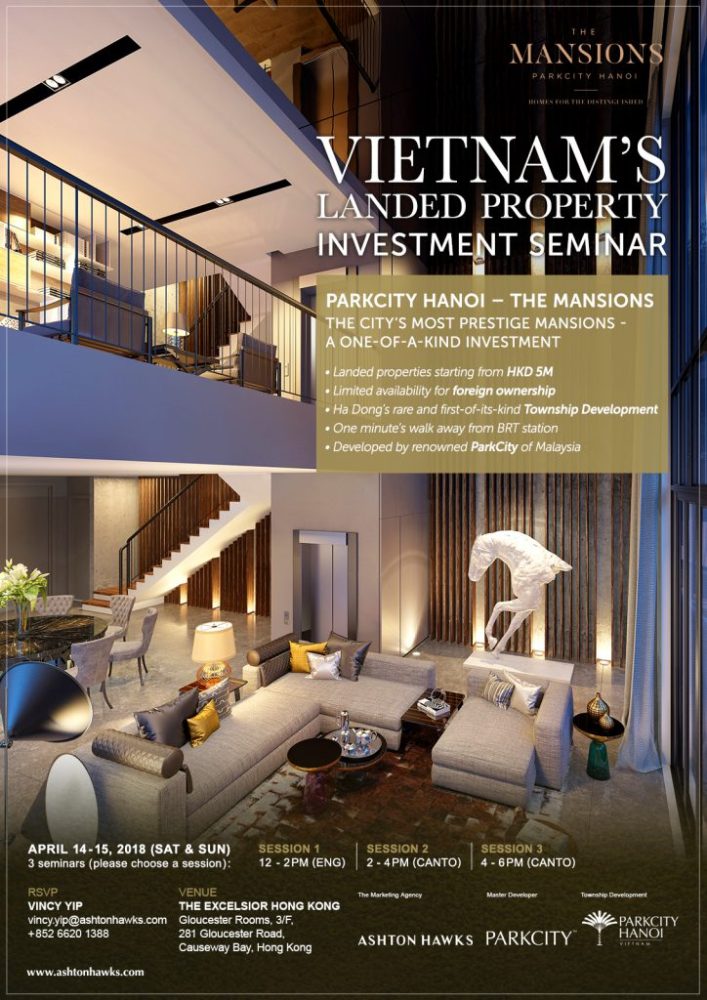

ParkCity Hanoi – The Mansions To be Launched Exclusively in Hong KongA One-of-A-Kind Investment in the Midst of Hanoi’s Soaring Economy

(April 6th, Hong Kong) Ashton Hawks will be partnering with Malaysia’s renowned developer, ParkCity to launch ParkCity Hanoi- The Mansions, a collection of 3 and 4-storey landed properties within Hanoi’s first prestigious township development, with prices starting from only HKD 5M at an average of HKD 1,600 per square foot. Landed properties are highly demanded even among local investors and with limited foreign ownership availability restricted by the government, this residential oasis is a rarity of its kind for overseas investors.

Vietnam has attracted much attention of overseas investors in the South East Asia property market as it flourishes under a strong economic trajectory and the Vietnamese government has implemented a series of reformation strategies to accommodate its soaring economic growth. The country’s outperforming GDP in Q1 of 2018 increased to 7.38% from 6.81% at the end of 2017. As the capital city, Hanoi’s property market is predicted to escalate as the city transforms into a businesses hub in the ASEAN region and benefits from China’s the ‘One Belt One Road’ initiative.

The country’s opening up to foreign property ownership has created much excitement for investors since 2015. Hanoi especially thrives under the spotlight as a core for businesses, trades and manufacturing. Its strong economic growth has attracted an influx of overseas capital injection which indirectly prospered a market boom. “Landed properties in prime location are highly demanded among local investors as land is limited in supply. Moreover, the number of units owned by foreigners must not exceed 250 landed property units in one particular administrative ward” said Mrs. Michele Cheng, Director of Ashton Hawks. With regards to her insight, “ParkCity Hanoi – The Mansions is the first landed property to offer a 10% foreign ownership which makes it a rarity among affluent residences in the city.”

ParkCity Hanoi – The Mansions, is developed by Malaysia’s renowned ParkCity, a subsidiary of the long-history global corporation, Samling Group. This distinctive property is nestled in the center of Ha Dong and is the first township development in Hanoi providing easy access to the newest CBD of Nam Tu Liem, manufacturing district of Bac Ninh through Ring Road 3 and the traditional CBD Hoàn Kiếm. The nearest BRT station, completed in 2016, is a one-minutes’ walk from the gated entrance. Besides its very own ParkCity Mall targeted to be completed bu end 2019, and international school, the township is surrounded by educational institutions like Hanoi University, Hanoi Architectural University and Japanese International School. Aeon Mall, to be completed in 2019, is reachable with a 5-minutes’ drive which will be able to satisfy the lifestyle and entertainment needs of its residents.

The Mansions, to be completed in Q1 to Q2 in 2020, is a gated community that offers 3- and 4- storey landed properties at sizes ranging from 3,524 to 5,216 square feet with a starting price of HK $1,600 per square foot. Residents of The Mansions can enjoy its exclusive private clubhouse as well as ParkCity Hanoi Club’s lavish amenities like its lap and kids pool, BBQ garden, gymnasium, meandering gardens and a multipurpose hall. This residential oasis offers 24-hour gated security, promising a private and distinctive living space.

The upscale ParkCity Hanoi – the Mansions, is well perceived by Ashton Hawk’s Director, Mr. Fred Ho, “it sits at a prime location and will be able to attract the city’s distinctive professionals, including a community of embassy elites.” The government of Hanoi has supported large-scale infrastructure projects including the expansion of Noi Bai International Airport, a new CBD development at Nam Tu Liem and the network of an MRT system to be completed in 2019. The nearest MRT station to The Mansions will only be a 15-minute walk and the new CBD Nam Tu Liem is only 6 stations away. Mr. Ho continues, “as the economy prospers in Hanoi, the city’s executive population will rise, and along with a decline of freehold land in prime locations, the value of any properties situated in convenient locations are prospected to boom.”

To discover the potential of this one-of-a-kind investment opportunity, ParkCity Hanoi – The Mansions, will be launched on April 14th (Saturday) and 15th (Sunday) 2018, during the Vietnam Landed Properties Investment Seminar at The Excelsior Hong Kong, Gloucester Rooms, 3rd Floor, 281 Gloucester Road, Causeway Bay.

Investment Seminar

April 14 – 15th, 2018 (Saturday and Sunday)

Please choose one of the following sessions:

Session 1: 12pm – 2pm (English)

Session 2: 2pm – 4pm (Cantonese)

Session 3: 4pm – 6pm (Cantonese)

Address: The Excelsior Hong Kong 3/F Gloucester Rooms

281 Gloucester Road Causeway Bay Hong Kong

For media enquiries, please contact:

Jacqueline Tsang

PR & Marketing Assistant

Tel: 21520488

Email: jacqueline.tsang@ashtonhawks.com

About Ashton Hawks

Ashton Hawks was established by a group of renowned investment gurus and private collectors who laid the very foundation of the discerning Ashton Hawks, balancing luxury leisure lifestyle and investment. Our headquarter office is located in Hong Kong, with overseas branches in Bangkok and Vietnam. Ashton Hawks’ real estate portfolio is as diverse in style as it is in mega-estate location across the globe, and caters to luxury lifestyles of all kinds. Ashton Hawks takes pride in being a boutique yet original real estate consultant in the luxury market segment for the ultra-affluent.

https://devwp02.visibleone.io/ashtonhawks/

About ParkCity Hanoi – The Mansions

| Project | ParkCity Hanoi – The Mansions |

| Developer | ParkCity |

| Location | Lê Trọng Tấn, La Khê, Hà Đông, Hà Nội, Vietnam, Hanoi, Vietnam |

| Legal Tenure | Leasehold 50 years with renewal possibility for foreigners |

| Site Area | NFA 3,524 – 5,216 sq. ft. |

| Type of development | 3-4 storeys Mansion Villas |

| Facilities & Services | Lap Pool, Lounge & Kids Pool, BBQ, Adventure Play Area, Gym, Outdoor Fitness Park, Multipurpose Hall & 24 hr. Security by Guards |